System Instructions

Introduction

This page provides instructions on how to add new or update existing banking information for Salesforce Portal invoices.

Instructions

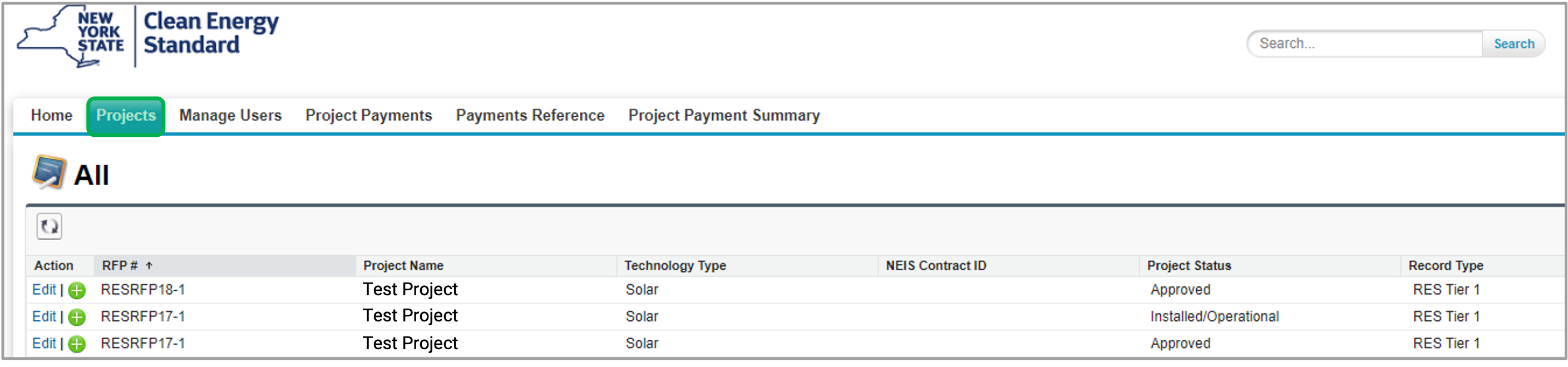

Log into Salesforce, then locate and access the correct Project Record.

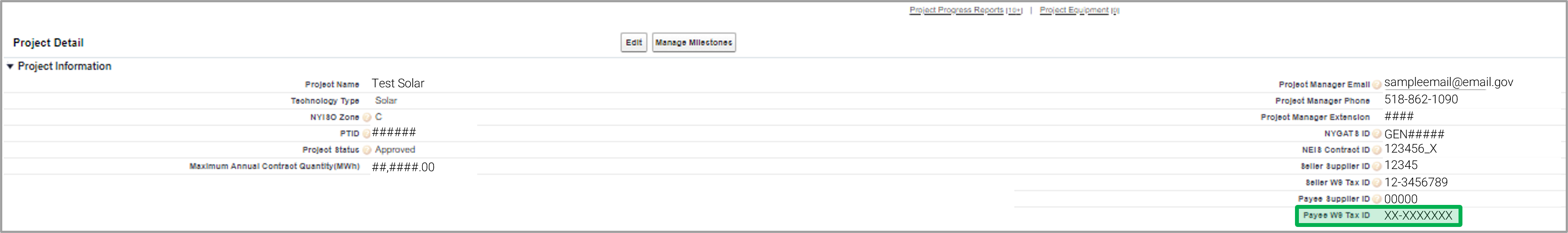

Once in the Project Record, click the Details tab and review the W-9 Tax ID Number in the project information to verify that the W-9 Tax ID Number is correct. If not, please contact your Project Manager (listed in the Portal) via email.

Once you confirm the Payee W-9 Tax ID Number is correct, sign up for Electronic Funds Transfer by completing this Form. Please use the Payee Supplier ID listed in the portal.

New requirements to add or update banking information. The information must be verified via Phone by the Authorized Signatory or Contract Signer only:

Requirements for first time EFT Enrollment: |

|

|---|---|

Requirements for Modifications to Existing EFT information: |

|